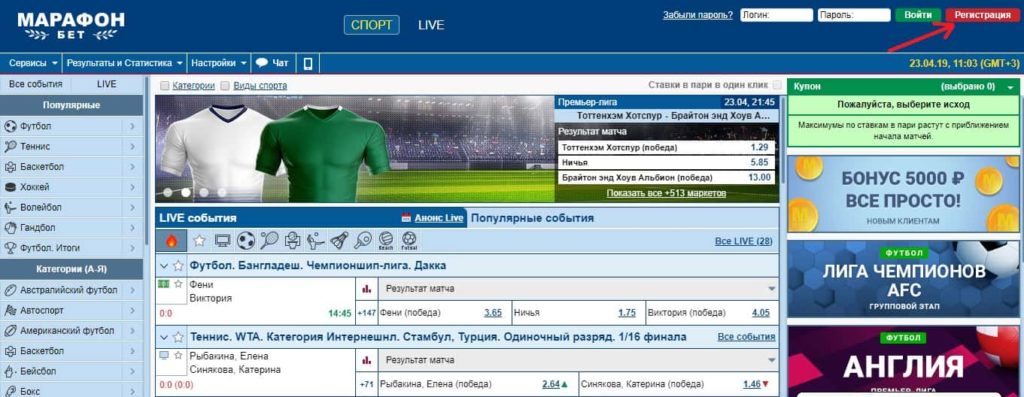

Marathonbet.ru: букмекерская контора МАРАФОН

Букмекерская контора «Марафон» была зарегистрирована в 1998 году в России.

В июле 2017 года компания открыла прием ставок онлайн в доменной зоне .ru.

Лицензия

Эта букмекерская контора принимает ставки на спорт онлайн в доменной зоне .ru на основании лицензии №14 ФНС России от 12 марта 2010 года. Этот букмекер входит в СРО «Ассоциация букмекерских контор» и подключен к ЦУПИС АО «КИВИ Банка».

ООО «Букмекерская контора «Марафон» (юридическое наименование) было зарегистрировано 16 января 1998 года в Москве, юридический адрес: 107113, г. Москва, ул. Маленковская, д. 32, стр. 3.

«Марафон» — титульный спонсор футбольных клубов «Севилья», «Жирона» и «Карпаты», а также официальный партнер «Манчестер Сити» и московского «Динамо».

Внесение средств

Пополнить игровой счет можно посредством платежных систем Visa, Mastercard, Maestro и МИР, Qiwi Wallet, «Яндекс.Деньги»; через мобильных операторов МТС, «Билайн», «Мегафон», Tele2.

Сумма минимального пополнения счета — 100 рублей для всех методов. Сумма максимального пополнения счета не ограничена.

Все депозиты зачисляются на игровой счет мгновенно. Компания покрывает затраты клиента на перевод.

Вывод средств

Средства с игрового счета можно вывести с помощью платежных систем Visa, Mastercard, Maestro, МИР, Qiwi Wallet, «Яндекс.Деньги»; на счет мобильных операторов МТС, «Билайн», «Мегафон» и Tele2.

Минимальная сумма вывода для всех методов составляет 730 рублей. Максимальная сумма вывода для всех методов не ограничена.

Средства выводятся обычно в течение трех часов. Комиссия со стороны букмекерской конторы отсутствует.

Валюта

Игровой счет в БК «Марафон» можно завести только в российских рублях.

Налог

Учтите: согласно п. 1 ст. 214.7 Налогового кодекса РФ, при осуществлении выплаты выигрыша клиенту букмекерская контора должна удерживать налог на доходы физических лиц в размере 13%. Налог вычитается из разницы между суммой выплачиваемого выигрыша и суммой сделанной интерактивной ставки.

Линия

БК «Марафон» предлагает такие продукты:

- ставки на спорт;

- ставки на киберспорт.

Можно сделать ставки на ТВ-шоу, политические события, собачьи бега и другие неспортивные события.

Также к услугам клиентов матч-центр со спортивной статистикой.

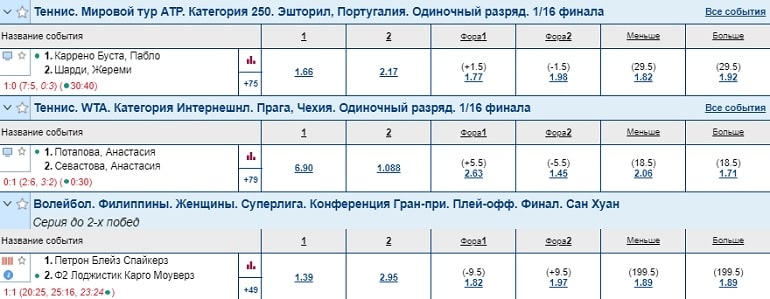

Прематч

В линии БК «Марафон» представлено более 25 видов спорта. Роспись ставок в прематче широкая. На событие дается близко 250 рынков: европейский гандикап и азиатские форы, обычные и азиатские тоталы на бой и на раунды, много ставок-комбинаций, ставок на статистику.

Средняя величина маржи в прематче – 2,5%

Лайв

Роспись ставок в лайве также широкая. На малопопулярный поединок по ходу события букмекер предлагает близко 100 рынков.

Средняя величина маржи в лайве — 8%.